Financial Modeling with Python

In this topic, we'll explore the exciting world of financial modeling with Python. Financial modeling involves building mathematical models to simulate the performance of financial assets, portfolios, or projects. Python's extensive libraries and tools make it an ideal choice for financial modeling tasks, ranging from simple calculations to complex simulations.

Introduction to Financial Modeling

Understanding Financial Models

Financial models are mathematical representations of financial assets, portfolios, or projects. They assist analysts and investors in making informed decisions by offering insights into potential future outcomes based on various assumptions and inputs.

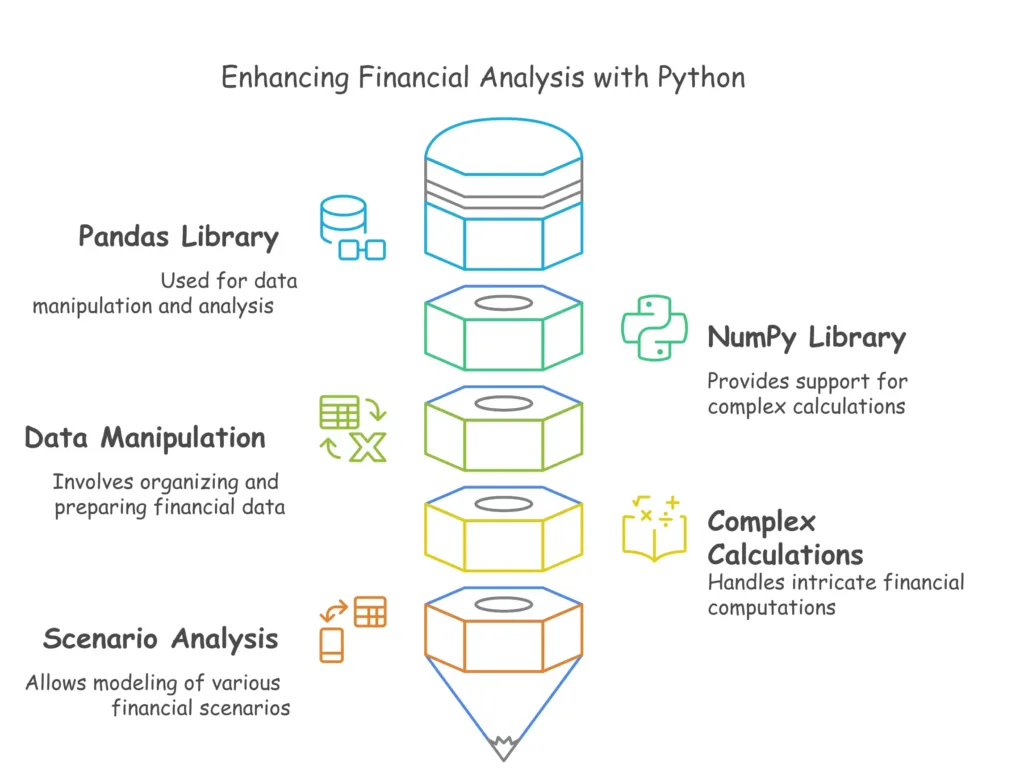

In the diagram, you can see how the following elements work together to produce outputs:

- Pandas Library: Facilitates efficient data manipulation and analysis.

- NumPy Library: Provides tools for complex mathematical calculations and array processing.

- Data Manipulation: Involves cleaning, transforming, and organizing data for analysis.

- Complex Calculations: Enables the execution of sophisticated financial computations.

- Scenario Analysis: Simulates and evaluates different financial scenarios to assess potential outcomes.

Together, these components form a workflow that leads to accurate and insightful financial modeling outputs.

Code Example: Simple Financial Model

# Define inputs

initial_investment = 100000

annual_growth_rate = 0.05

years = 10

# Calculate future value using compound interest formula

future_value = initial_investment * (1 + annual_growth_rate) ** years

# Display the future value

print("Future Value:", future_value)

Explaination:

This code snippet demonstrates a simple financial model to calculate the future value of an investment based on compound interest.

Basic Financial Calculations

Time Value of Money (TVM)

TVM calculations are fundamental in financial modeling and involve analyzing the value of money over time, considering factors like interest rates and cash flows.

Code Example: TVM Calculation

import numpy as np

# Calculate present value of a cash flow

cash_flows = [10000, 20000, 30000, 40000]

discount_rate = 0.1

present_value = np.npv(discount_rate, cash_flows)

# Display the present value

print("Present Value:", present_value)

Explaination:

- This code snippet demonstrates how to calculate the present value of a series of cash flows using Python’s NumPy library.

Net Present Value (NPV) and Internal Rate of Return (IRR)

NPV and IRR are important metrics in financial modeling for evaluating investment opportunities and projects.

Code Example: NPV and IRR Calculation

# Calculate NPV and IRR

npv = np.npv(discount_rate, cash_flows)

irr = np.irr(cash_flows)

# Display the NPV and IRR

print("NPV:", npv)

print("IRR:", irr)

Explanation:

This code snippet calculates the NPV and IRR of a series of cash flows using NumPy.

Advanced Financial Modeling Techniques

Monte Carlo Simulation

Monte Carlo simulation is a powerful technique used in financial modeling to simulate a range of possible outcomes by randomly sampling from input distributions.

Code Example: Monte Carlo Simulation for Stock Prices

# Simulate future stock prices using Monte Carlo simulation

num_simulations = 1000

simulation_period = 252

volatility = 0.2

initial_price = 100

daily_returns = np.random.normal(0, volatility / np.sqrt(simulation_period), (num_simulations, simulation_period))

stock_prices = initial_price * np.exp(np.cumsum(daily_returns, axis=1))

# Display the simulated stock prices

print(stock_prices)

Explanation:

This code snippet demonstrates how to use Monte Carlo simulation to generate simulated future stock prices based on a geometric Brownian motion model.

Sensitivity Analysis

Sensitivity analysis helps assess the impact of changes in input variables on model outputs, providing insights into the model’s robustness and sensitivity to different scenarios.

Code Example: Sensitivity Analysis

# Perform sensitivity analysis on a financial model

input_values = [0.1, 0.2, 0.3, 0.4, 0.5]

output_values = []

for input_value in input_values:

output_value = calculate_output(input_value) # Function to calculate model output

output_values.append(output_value)

# Display the sensitivity analysis results

print("Input Values:", input_values)

print("Output Values:", output_values)

Explanation:

This code snippet demonstrates how to perform sensitivity analysis on a financial model by varying input values and observing changes in output values.

Real-World Applications and Case Studies

Case Study: Predictive Modeling for Stock Prices

In this case study, we’ll build a predictive model for forecasting stock prices using machine learning techniques like linear regression and random forests.

Code Example: Predicting Stock Prices with Random Forests

from sklearn.ensemble import RandomForestRegressor

from sklearn.model_selection import train_test_split

# Split data into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(features, target, test_size=0.2)

# Train a random forest regression model

model = RandomForestRegressor(n_estimators=100)

model.fit(X_train, y_train)

# Make predictions

predictions = model.predict(X_test)

# Evaluate the model

mse = mean_squared_error(y_test, predictions)

print("Mean Squared Error:", mse)

Explanation:

This code snippet demonstrates how to build and evaluate a random forest regression model for predicting stock prices using scikit-learn.

Financial modeling with Python opens up a world of possibilities for analysts, investors, and financial professionals. We've explored the foundational principles and advanced techniques involved in building robust financial models using Python. Happy coding! ❤️